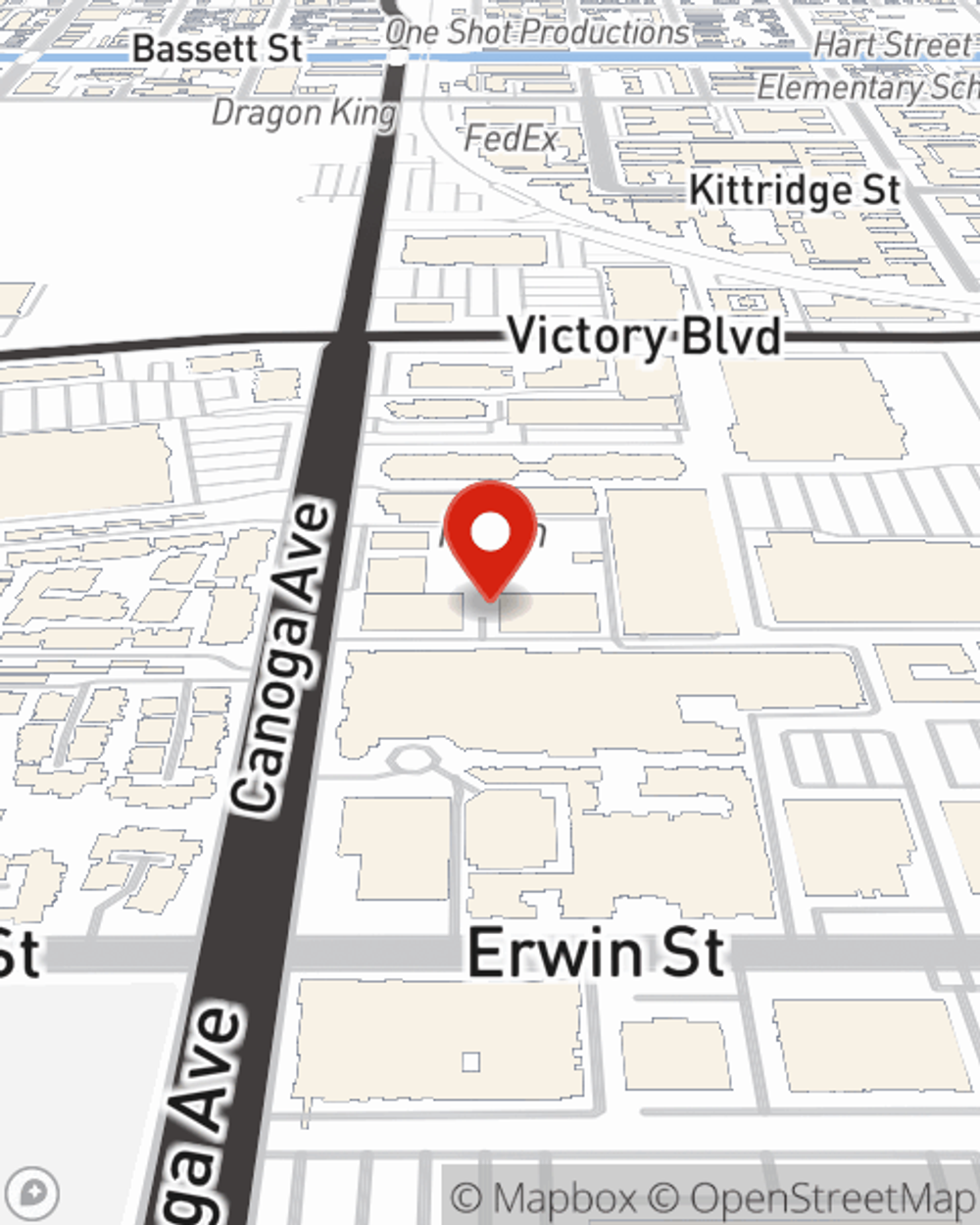

Condo Insurance in and around Woodland Hills

Get your Woodland Hills condo insured right here!

Insure your condo with State Farm today

Home Is Where Your Condo Is

When looking for the right condo, it's understandable to be focused on details like your future needs and location, but it's also important to make sure that your condo is properly protected. That's where State Farm's Condo Unitowners Insurance comes in.

Get your Woodland Hills condo insured right here!

Insure your condo with State Farm today

Condo Unitowners Insurance You Can Count On

Your home is more than just a roof over your head. It's a refuge for you and your loved ones, full of your personal items with both sentimental and monetary value. It’s all the memories attached to every room. Doing what you can to help keep it safe just makes sense! And one of the most reasonable things you can do is getting a Condominium Unitowners policy from State Farm. This protection helps cover a plethora of home-related troubles. For example, what if an intruder steals your tablet or someone vandalizes your property? Despite the disappointment or loss from the experience, you'll at least have some comfort knowing your State Farm Condominium Unitowners policy that may help. You can work with Agent Jay Lawson who can help you file a claim to help assist covering the cost of your lost items. Preparing doesn’t stop troubles from landing on your doorstep. Coverage from State Farm can help get your condo back to its sweet spot.

Finding the right coverage for your unit is made easy with State Farm. There is no better time than today to contact agent Jay Lawson and discover more about your fantastic options.

Have More Questions About Condo Unitowners Insurance?

Call Jay at (818) 700-1744 or visit our FAQ page.

Simple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

Simple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.